|

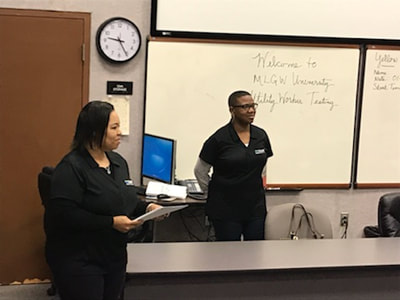

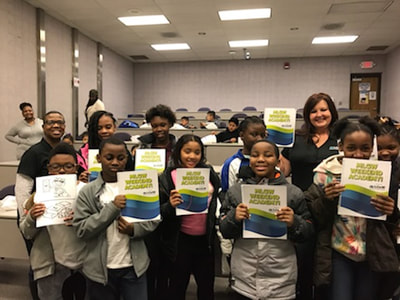

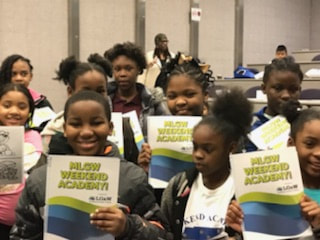

On January 27, 2018, staff members of LG&W Federal Credit Union taught a course on financial literacy to dozens of elementary school kids through MLGW Weekend Academy. The course discussed the value of savings, budgeting, and being smart about money decisions.

If you're expecting a refund from the IRS this year, resist the temptation to splurge on luxuries and instead invest that money in ways that will pay off in the long run. Here are five smart ideas to put that tax refund to good use:

Open an account for emergencies. Any financial advisor will tell you that an Emergency Fund is one of the most important steps in building financial security. Get peace of mind knowing you have cash for emergencies or unexpected situations by opening a special account with your tax refund. Advisors typically recommend to build a fund that covers three months of your salary. Pay off those credit cards! If you have credit card debt, paying it off is a smart way to use your tax refund. If your refund doesn’t cover the entire outstanding balance, roll your remaining debt to a credit card with a lower interest rate or look for a lower-interest debt consolidation loan. Invest in yourself. Your skill set is your greatest commodity in revenue generation, so use your refund for training, education, conferences and other programs to help build your talents and sharpen your strengths. Get energy efficient. Use that extra cash to make your home energy efficient to save money over time on electrical, heating and water bills. For example, by adding fiberglass attic insulation, you’ll recoup 107% of the $1,343 average cost for installation. Plus, energy efficient homes help with a home’s resale value. Invest in your community. Giving to charitable causes in your community that you care about not only helps those in need, but makes you feel good about yourself and helps improve your community. Think about using a portion of your refund to make a difference in someone’s life for the ultimate gift to yourself. If you're married and have felt the stress of dealing with financial matters with your spouse, then you're pretty normal! Money is a leading cause of stress in marriages because money is often used to express love and security. So how can you deal with money matters while maintaining a strong relationship with your spouse?

GET IN SYNC: Create a budget TOGETHER so that you both can agree on and understand how your family dollars are being spent. Building a budget helps prioritize your life goals as a family. Perhaps education is something that you both value, or maybe it's world travel, or maybe it's a bigger house. By working through the budget process, spending and savings priorities for both spouses will be revealed and will create better understanding of the financial goals each of you are working towards. SPEAK UP: Perhaps you have an outstanding loan or debt and to avoid conflict, you haven't quite mentioned it to your spouse. Being dishonest about your financial situation is a sure-fire way to lead to hurt feelings and suspicion in your relationship. Your financial situation affects your spouse so you owe it to them to share you situation no matter how uncomfortable it may be. On the flip side, if your spouse is overspending and being careless with finances, it may be time to have a talk to reel in their spending habits. REMEMBER WHAT HAS TRUE VALUE: Don't let money be the driver of your relationship. Take time to be grateful for the things that bring you joy in your relationship - laughter, walks, talks, watching your children grow. Show your spouse that you love them by showering them with things that don't cost money like running an errand for them, cooking their favorite dinner, and just being kind. It's true, the best things in life are free! |

Our BALANCE Financial Guide is dedicated to helping you balance life’s important decisions.

Archives

August 2023

Categories

All

|